House Loan Analysis

DESCRIPTION :

•For safe and secure lending experience, it's important to analyse the past data.

•In this project, I have to build a deep learning model to predict the chance of default for future loans using the historical data.

•As you will see, this dataset is highly imbalanced and includes a lot of features that make this problem more challenging.

Objective :

•Create a model that predicts whether or not an applicant will be able to repay a loan using historical data.

•Performing data preprocessing and build a deep learning prediction model.

•Removed the variable which contains null values.

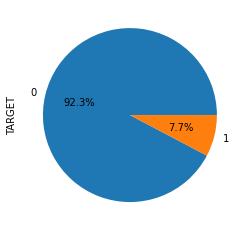

•Checking that target varaible has imbalanced data or not.

imbalance Data

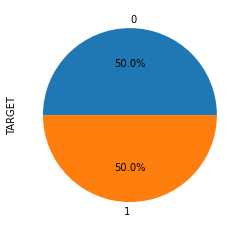

•By using Oversampling techinque target varibale data are now balanced.

Balanced Data

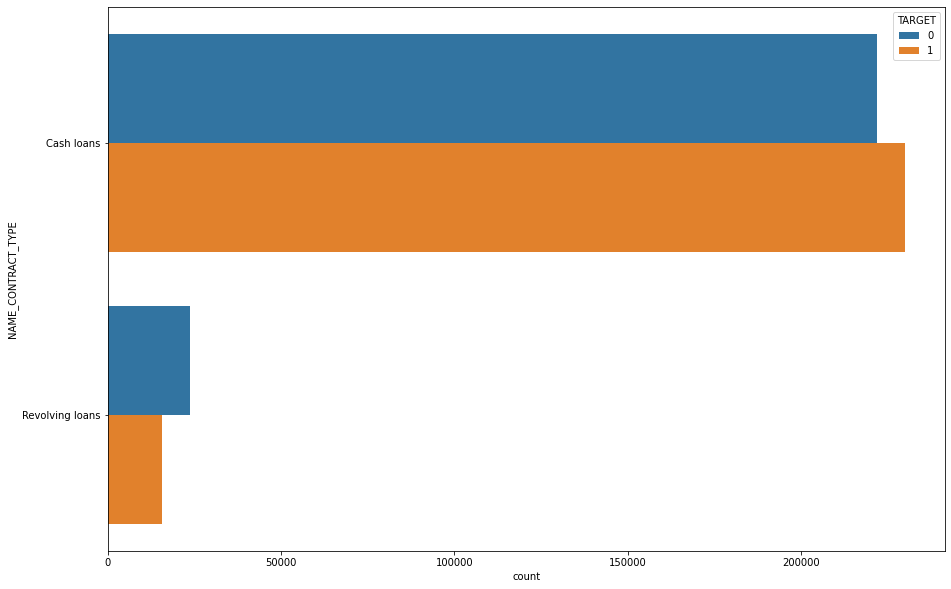

•Encoding the columns that is required for the model development

Contract Type

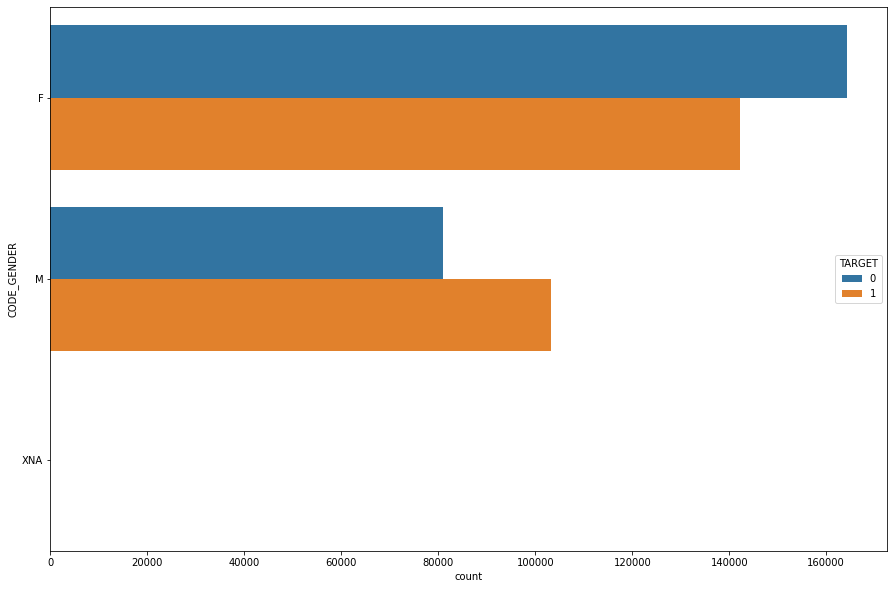

Code Gender

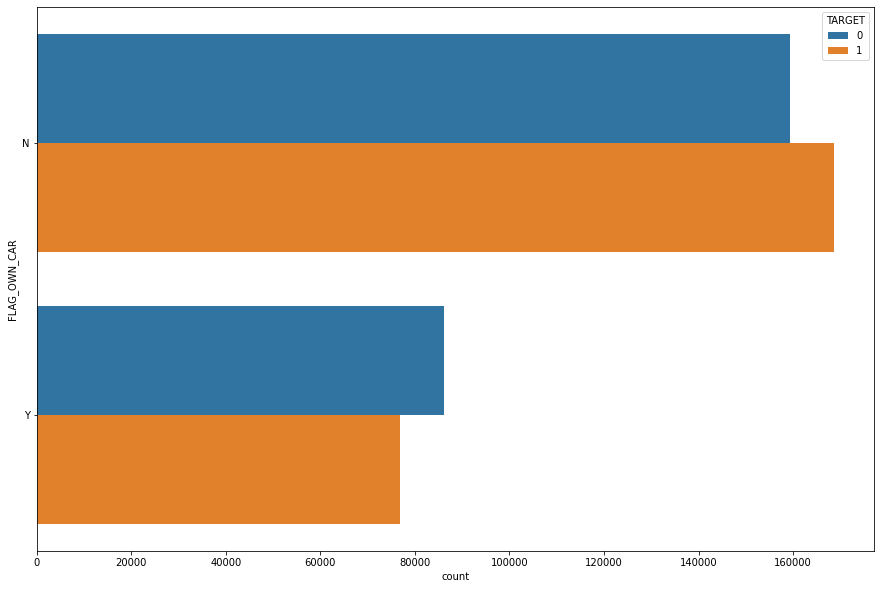

Flag Own Car

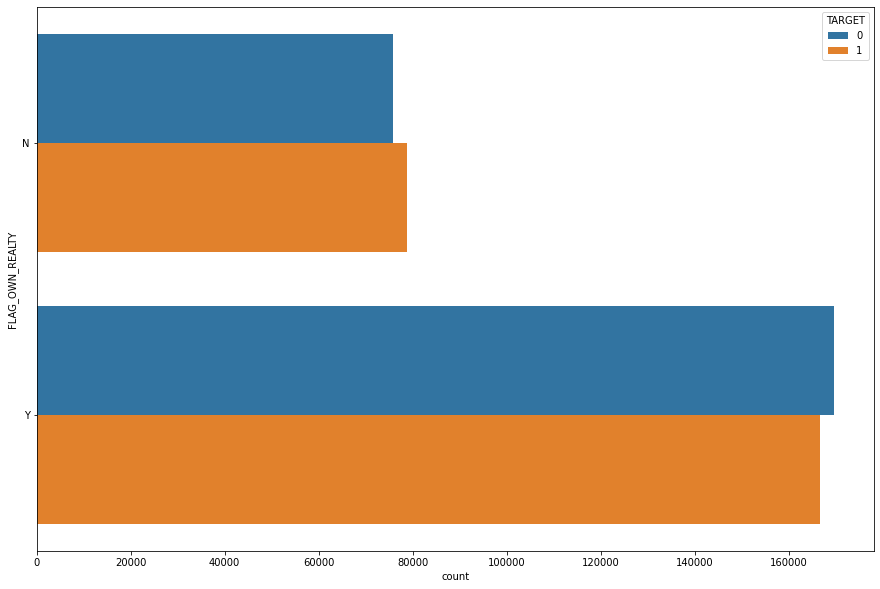

Flag Own Realty

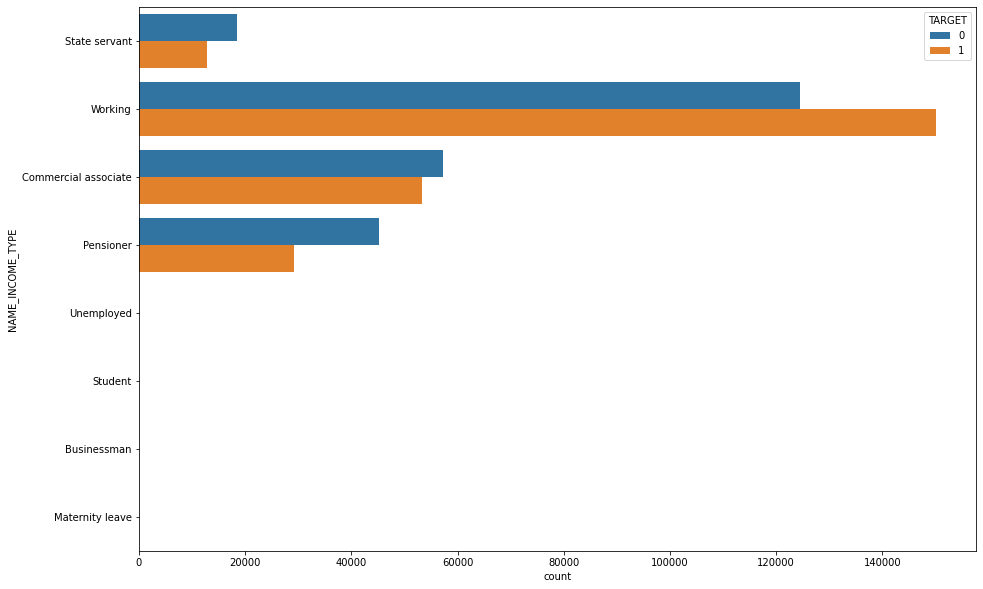

Income Type

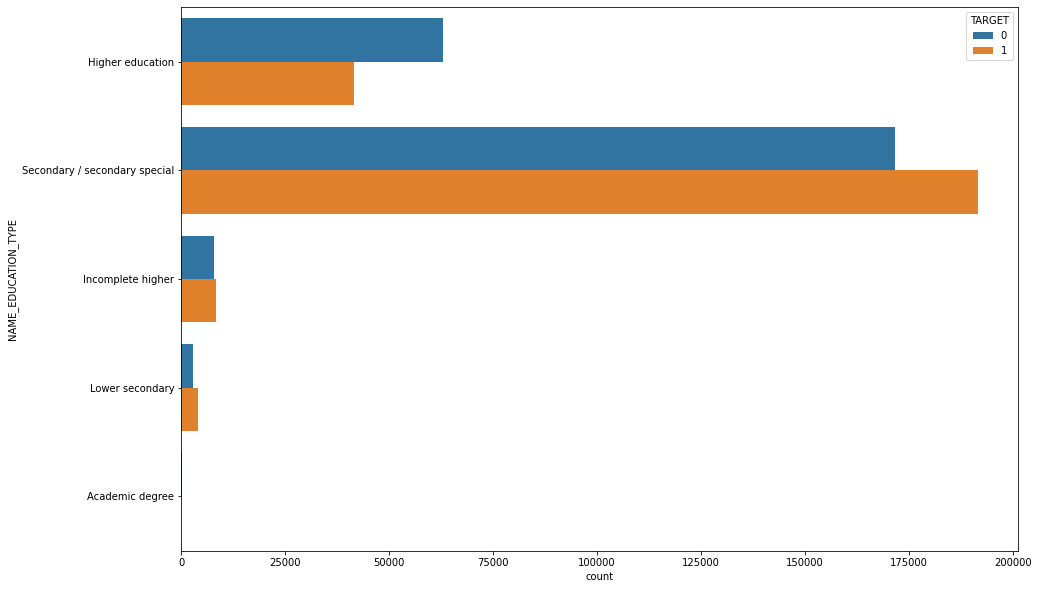

Education Type

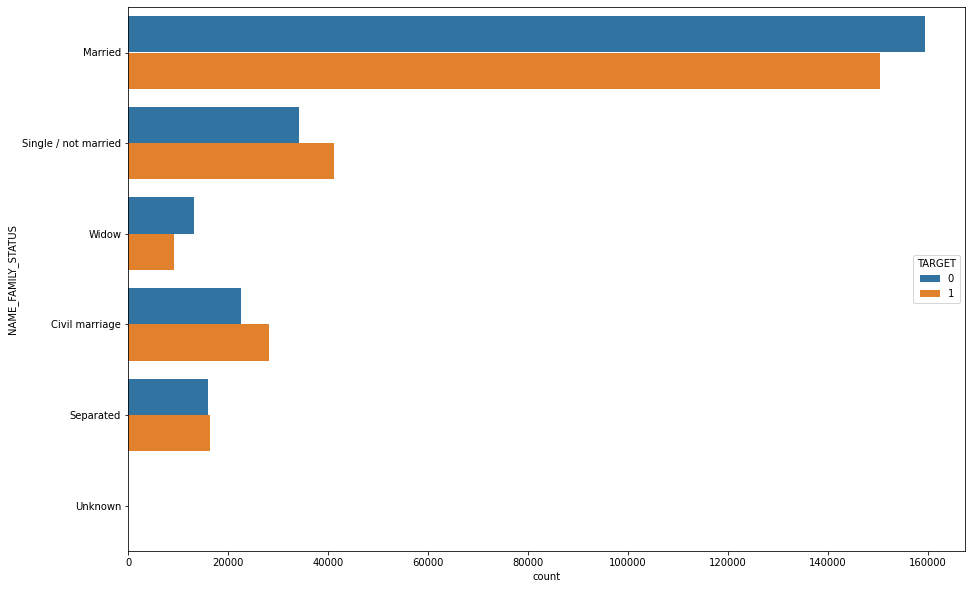

Family Status

Housing Type

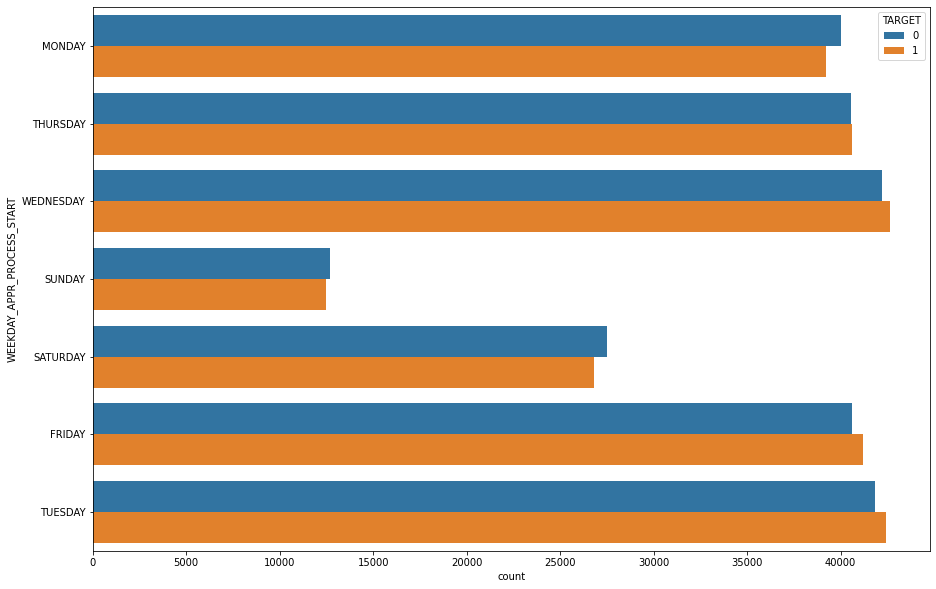

Weekday Process

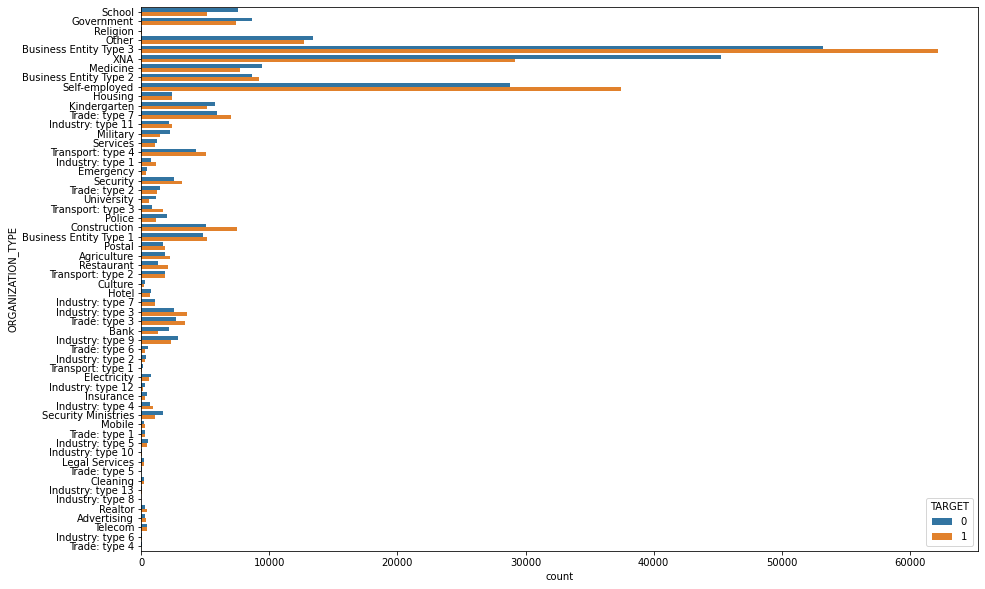

Organization Type

•For pre-processing MinMaxScaler was used.

•After applying EDA and feature engineering,we are now ready to build the predictive models.

•For creating deep learning model Keras and Tensorflow will be used.

•Calculate area under receiver operating characteristics curve.

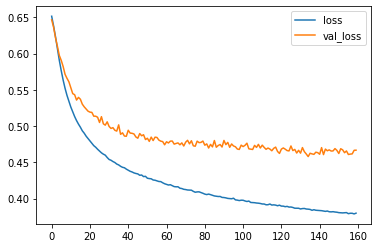

Loss Validation

•Model accuracy is 78%.

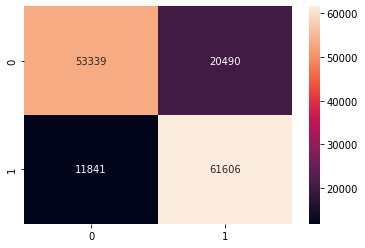

Confusion Matrix